Office Real Estate: The Iceberg Dead Ahead

I'm writing this in early May 2023. The depths of the COVID-19 are behind us and we're now solidly in a post-COVID world... The pandemic changed a lot of things throughout society, and many of the second and third order impacts of these changes are starting to appear.

One major risk that I'm keeping tabs on is what could be a coming crisis in commercial office real estate driven by the work from home / hybrid work movement, and the fast rise of interest rates. If this comes to fruition, the impact on the economy across North America could be severe.

Some Background

Work from Home / Hybrid

In spring of 2020, during the early days of the pandemic many (most?) jurisdictions implemented restrictions on indoor gatherings, including in offices. This forced many businesses with an in-person, white collar, workforce to quickly adapt and shift to a work from home model. As the pandemic evolved and dragged on through 2021 and into 2022, many of the individual employees continued to work from home due to continued government restrictions, risk adverse company policy, or a desire for flexibility.

After a two year stint of the work from home experiment, a lot of people aren't coming back to the office. Some companies have realized they are as productive or more productive in a virtual setting, and some employees have realized they much prefer working remote and won't ever go back to an in-person job.

Other companies recognize the value of having some in-person interactions, but want to maintain the flexibility of work from home and are trying hybrid models where working hours are split between the office and home.

Work from home and hybrid are driving down demand for square footage of office space because there are just less people coming into the office than there used to be pre-pandemic, and many businesses no longer see the need to continuing paying rent on their offices.

Current Vacancy Rates

In May 2020 the former CEO of Google, Eric Schmidt, made a prediction that the demand for office space would increase as the result of the pandemic. In the long run, he might still be right, but in the near term the data is telling a different story.

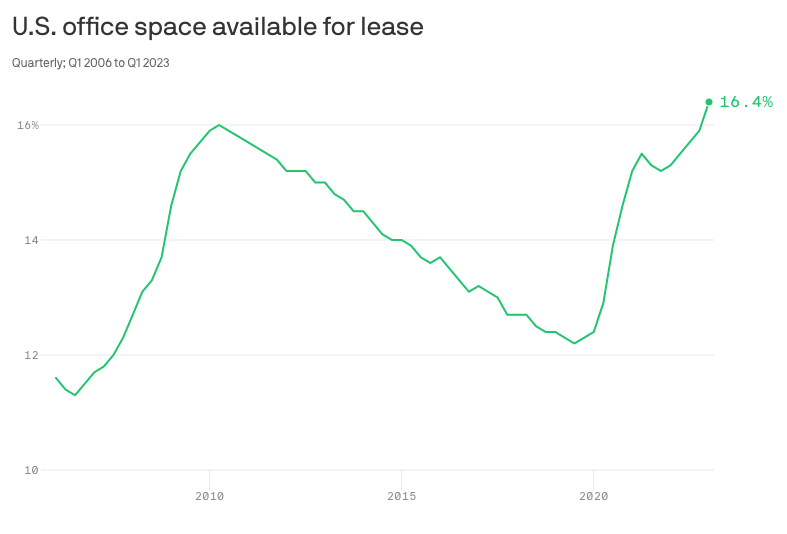

Office vacancy rates are up across the board in downtown cores in the United States and Canada. According to a recent article from Axois, available office space in the USA is now at an all time high, surpassing the previous high set after the great financial crisis.

Vacancy rates in the 5-8% range have historically been the average for a regional economy that is fairly stable and healthy. We are more than double the high end of the healthy range and the trend looks like it will get worse before it gets better (if it gets better). This isn't a regional problem - these are the average numbers across the entire United States, meaning the problem is systemic (nor is it limited to the USA... Canada may be in a worse position).

This chart shows office space available, which includes tenants who are attempting to sublet unused space - the percentage of unleased space is slightly lower at 12.9%, but this brings us to the next point...

Office Lease Terms

Current vacancy rates are high, but it gets worse because of lease terms. A standard short term lease on an office space is 3-5 years, while long term leases typically run 10 years. The posted vacancy rates include office space that was rented pre-pandemic where some businesses are paying full price for under utilized space. As those leases roll over, its reasonable to expect that some will not renew, will renew with a lower footprint, or will be in a position to renegotiate at a much reduced lease rate.

Expect to see office vacancy rates continue to climb over the next two years as leases roll over, and for average rates in those buildings for new leases to decrease over the same period. From the perspective of the building owner, higher vacancy + lower rent is a big problem.

High vacancy + low rent = a big problem

Interest Rates

One more thing that is going to cause pressure in the office real estate world is the rapid rise of interest rates. As of this article, the target Fed funds rate is 4.75-5.0% and the Bank of Canada overnight rate is 4.5%.

Looking back over the past 100 years, by historical standards, these values aren't high - the average value of the Banker's Acceptance Rate (precursor to the Fed Funds Rate) from 1940 to 1981 was 4.96%. From 1982, when the Fed Funds Rate was implemented, through to 2020 the average rate was 3.02%, but this is heavily influenced by the period following the great financial crisis where the interest rate was near zero from 2008 to 2015. Interest rates have also been MUCH higher than they are today - in 1981 the Fed Funds rate peaked at over 19%!

Long story short, interest rates today aren't wildly out of the ordinary compared to historical values.

What is different, is how FAST they have risen. Since it was instituted, the median rate of change of the Feds Funds Rate in a calendar year is only 0.45%. The rate is generally pretty stable and this predictability allows businesses (lenders and borrowers) to plan and adjust accordingly. In February 2022, the rate was effectively zero (0.08%), and a year later it had risen to 4.65%. That's 10 times faster than interest rates have historically risen. (Yes, there have been other times when interest rates have changed quickly - usually falling. In the cases where interest rates rose quickly, there were also economic shocks that happened, such as 1978 through 1983.)

Interest rates changing this quickly is causing a lot of stress for the banks who hold treasuries on their balance sheets because the value of bonds they bought 8 months prior has now cratered (Silicon Valley Bank being the case study).

Commercial office buildings are highly levered. The equity that a developer/owner maintains in a building is generally low, and the rest is debt funded by commercial mortgages (often regional banks - the same ones being squeezed by yields on treasuries) and by institutional investors who buy corporate bonds.

There is an estimated $1.5T in debt coming due (paywall warning) to be renegotiated before the end of 2025. Higher interest rates from the central banks mean higher mortgage rates and higher bond coupons for the building owners.... now we can add higher cost of borrowing to the earlier equation:

Higher cost of borrowing + high vacancy + low rent = a gigantic problem

The Economy is the Titanic, Empty Office Towers are the Iceberg

If you've made it this far, I have painted a pretty nasty picture for the owners of office towers. They are facing a trifecta of bad news, but so what? If I'm not a builder of office towers, or someone fits up the spaces inside those buildings, why does this matter to me?

It matters because the scale of this problem is huge and systemic. This isn't a regional problem that affects a single city or state, this is something that appears to be pervasive across North America. In 2008, the residential real estate market had a meltdown that resulted in a banking crisis and a severe recession. We're staring down a very similar problem again, just with commercial real estate instead of residential real estate.

If commercial real estate implodes, expect a regional banking crisis resulting in shocks and a general slowdown of the broader economy. Widespread defaults on office tower debt has potential to erode the tax base, sink other supporting businesses, distress banks, and cripple pension funds.

While stimulus through new infrastructure projects is one way governments deal with broad based economic downturns, this time might be different. Governments are already dealing with significant debt burdens from support and stimulus during the pandemic and the additional costs from dealing with an economic crisis will test their capacity before factoring in additional funds for infrastructure.

How You Can Protect Yourself

Wow, Andrew - this article is a real downer. Yes, and I'm sorry. Not only am I sorry, but I very much hope that I'm wrong. I'm generally an optimist about life and I don't want to see another global economic crisis unfold.

In part 2 of this thread, I'll discuss some strategies that may help lessen the blow of a major economic crisis for both construction business owners and individuals working in the construction industry.

If there is a silver lining to any of this, if things do go south, the strategies I'm about to outline may help to lessen the blow, and if I'm wrong and things stay rosy - the strategies will turbocharge your forward looking potential!

Subscribe today to get notified when Part 2 is published!